In an era where environmental stewardship intersects with financial opportunity, green real estate has emerged as a powerful avenue for investors who seek both profit and purpose. By integrating sustainable design, advanced technology, and community-minded strategies, you can craft a property portfolio that yields strong returns while leaving a positive imprint on the planet. This article explores how to navigate the evolving landscape of eco-friendly real estate in 2025 and beyond, offering practical insights to guide every step of your investment journey.

The momentum behind sustainable property has never been stronger. Today’s buyers and tenants demand more than four walls and a roof: they want homes that foster wellbeing, minimize environmental impact, and stand resilient against the challenges of a changing climate. As governments, developers, and financiers align around greener standards, now is the time to position your portfolio at the forefront of this industry transformation.

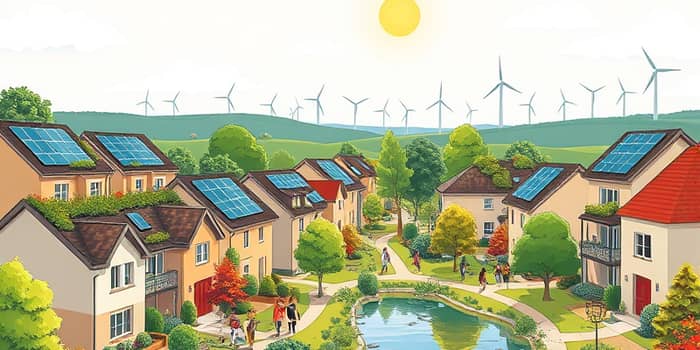

Once considered a niche market, sustainable real estate is now mainstream. New residential developments routinely incorporate solar panels, geothermal heating, and high-performance windows. These features not only lower utility bills but also deliver the kind of home experience that modern consumers crave: fresh air, abundant natural light, and a seamless connection to the outdoors.

Market data confirms the trend. The International Energy Agency estimates that residential buildings account for roughly 30% of global energy-related CO2 emissions. By focusing on energy-efficient upgrades, investors can play a vital role in reversing this statistic while capturing value: eco-certified homes consistently command price premiums and sell faster than legacy properties.

Several powerful forces are reshaping real estate investment:

Together, these drivers are fueling a surge of capital into projects that marry environmental purpose with economic potential, creating a feedback loop where sustainability becomes synonymous with sound investment.

Investing in green real estate delivers a suite of financial advantages. Properties with certifications such as LEED, BREEAM, or ENERGY STAR often benefit from premium pricing and higher demand, thanks to growing awareness of their lower operating costs and reduced carbon footprints.

Lower utility bills and maintenance costs translate into stronger net operating income, while tax rebates and government incentives boost initial returns. Furthermore, eco-friendly homes often spend fewer days on market, accelerating cash flow and reducing holding costs.

The core of every green building lies in its design and material choices. By integrating features such as solar photovoltaic arrays, geothermal HVAC systems, and advanced insulation and smart thermostats, you can slash energy consumption by up to 50%, depending on the local climate and building size.

Biophilic design—in which buildings incorporate natural light, indoor gardens, and water features—has been shown to reduce stress levels, increase productivity, and heighten overall occupant satisfaction. These attributes not only enhance community wellbeing but also strengthen tenant retention and reduce vacancy rates.

Governments around the world are adopting regulations and incentives to propel sustainable construction. From federal tax credits for solar installations to municipal grants for green retrofits, the policy landscape rewards investors willing to embrace eco-conscious development.

Success in this space often hinges on cross-disciplinary collaboration. Architects, developers, investors, and material suppliers must work in concert to streamline building processes, select cost-effective technologies, and ensure compliance with evolving standards. By fostering strong partnerships, you can mitigate supply chain disruptions and achieve economies of scale that drive down project costs.

Meanwhile, non-green assets face growing obsolescence risk as regulatory bodies tighten energy codes and as consumers increasingly avoid properties with high carbon footprints. A forward-looking investment strategy proactively addresses these trends rather than reacting to them.

No investment is without risk, and green real estate presents its own challenges. Upfront capital requirements for retrofits or new builds can be significant, demanding a rigorous analysis of payback periods and long-term savings.

By conducting thorough due diligence—evaluating climate risk maps, assessing local incentive programs, and stress-testing financial models—you can mitigate these uncertainties and build resilience into your portfolio.

Big data analytics and artificial intelligence now enable investors to identify high-potential properties, estimate green IRR, and predict tenant preferences with unprecedented accuracy. Real-time IoT sensors monitor energy and water usage, allowing for proactive maintenance and transparent reporting to stakeholders.

Imagine a property dashboard that alerts you to a spike in energy consumption in one unit, enabling swift corrective action before costs escalate. These digital tools not only optimize building performance but also heighten tenant satisfaction by demonstrating a tangible commitment to sustainability.

The horizon for green real estate shines bright. As sustainable construction becomes an industry standard by 2025, investors who establish a pioneering presence will reap outsized rewards. To stay ahead, consider these strategic imperatives:

Ultimately, building a green portfolio is about more than financial metrics. It is an opportunity to drive meaningful change—reducing emissions, improving health outcomes, and contributing to more equitable and resilient communities. By aligning purpose with profit, you position yourself not only as a savvy investor but also as a champion of a sustainable future.

Now is the moment to harness the full potential of green real estate. Let your portfolio reflect the values of tomorrow, delivering a legacy of environmental responsibility and lasting prosperity.

References