The Anthropocene, a term capturing the era in which humans are the dominant planetary force, demands a new paradigm for sustainable investment. As global systems strain under the weight of unprecedented change, investors, policymakers, and communities face a pivotal choice: continue on a path of environmental degradation or mobilize capital toward healing Earth’s fragile ecosystems. This article delves into the science, challenges, and, most critically, the investment opportunities that transform jeopardy into hope and responsibility.

Emerging in conversation although not yet formally recognized by geological bodies, the Anthropocene labels our current geological age. Since the industrial revolution, humanity’s imprint on Earth has accelerated; atmospheric carbon dioxide soared from 280 ppm to over 420 ppm within two centuries, triggering climate instability, acidifying oceans, and destabilizing weather patterns. The concept underscores an essential reality: our species now shapes river flows, soil composition, and atmospheric chemistry on a planetary scale.

Yet within this stark context resides an invitation. By acknowledging the Anthropocene, society can embrace planetary stewardship as a collective imperative, weaving scientific insight with financial innovation to guide a safer, fairer future for all inhabitants of Earth.

The scale of human-driven change is staggering. Accelerated species loss suggests we are entering a “sixth mass extinction,” with over one million species threatened with extinction. Nearly half of global land ecosystems have been converted for agriculture, settlements, and industry, while chemical pollutants and plastics infiltrate air, water, and soil.

Water scarcity now affects billions, exacerbated by damming and inefficient irrigation that sequester nearly one-fifth of river sediment. Industrial nitrogen fixation has doubled natural rates of nitrogen deposition, fueling harmful algal blooms and disrupting marine food webs. These trends magnify social inequalities, disproportionately impacting vulnerable communities and challenging notions of environmental justice.

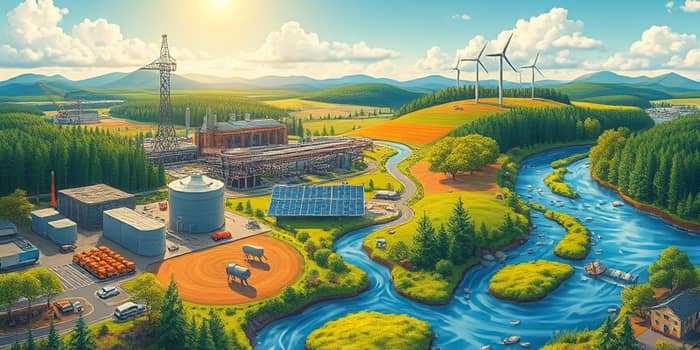

In response, a new investment frontier has emerged—one that prioritizes both mitigation of harm and ambitious restoration. Capital markets, philanthropic organizations, and public funds are channeling resources into diverse themes that promise ecological and economic returns.

Identifying where to invest requires clear metrics and scalable models. The following table illustrates select sectors, focal points, and anticipated outcomes for guiding strategic allocation of capital:

The scale of opportunity is immense. Global ESG (Environmental, Social, Governance) assets surpassed $35 trillion in 2020, reflecting a surge of investor appetite for environmental solutions. Climate-aligned funds, sustainable bonds, and green loans are growing rapidly, while natural capital markets—encompassing carbon credits, biodiversity offsets, and ecosystem service payments—offer novel pathways for monetizing environmental benefits.

Governments and regulators play a critical role. Carbon pricing schemes, mandatory climate disclosures, and sustainable procurement policies are driving transparency and steering private capital toward sustainable projects. Corporate commitments, including net-zero or “nature positive” commitments enshrined in science-based targets, are reshaping business models across industries and signaling long-term demand for green technologies.

Despite progress, challenges remain. The window for meaningful intervention is narrow: delayed action risks locking in irreversible tipping points. Critics warn of greenwashing and superficial sustainability claims that obscure genuine impact. Moreover, the uneven distribution of costs and benefits demands attentive governance to avoid exacerbating existing inequalities.

Geoengineering proposals—such as solar radiation management and ocean fertilization—spark controversy over efficacy, governance, and moral hazard. While these approaches underscore human ingenuity, they also highlight the complexity of intervening in Earth’s tightly coupled systems.

Investing in the Anthropocene is more than an asset class; it is a commitment to stewardship that transcends sectoral boundaries. By aligning financial flows with ecological and social objectives, we can pivot from extractive models toward approaches that heal landscapes, revitalize communities, and secure resilient economies.

The path forward demands collaboration among investors, scientists, policymakers, and local stakeholders. It requires rigorous impact measurement, adaptive management, and a willingness to learn from indigenous knowledge systems and community-driven solutions. Above all, it calls for courage—the courage to envision a world where prosperity is decoupled from environmental harm, and where every investment plants the seeds of renewal.

As the age of the Anthropocene unfolds, the choices made today will shape the world inherited by future generations. By harnessing the power of investment for regeneration, we can transform fraught challenges into expansive opportunities. This is a moment to act boldly, to invest wisely, and to embrace a proactive restoration and regeneration ethos that ensures Earth’s vitality endures. Together, we can reimagine finance as a force for healing—turning the Anthropocene into an era defined not by domination, but by collective possibility and hope.

References